The BERNAS PP Programme is an initiative of the bank to offer working capital financing to the service providers under BERNAS supervision for planting and crop management of paddy farmers who supply paddy to the BERNAS factory.

Shariah Concept

- Tawarruq

The Shariah Concept applied for this programme is Tawarruq.Tawarruq consist of two sale and purchase contracts where the customer purchases the Commodity from the Bank at a mark-up sale price (Bank’s Sale Price) on a deferred payment basis and subsequently sells the Commodity to a Commodity Supplier for cash at the Bank’s Purchase Price with the objective of obtaining cash.

Financing Facility

Financing Amount

- Minimum: RM50,000

- MaXimum: RM500,000

Profit Rate

- 4% per annum calculated on monthly balance

Facility Tenure

- Up to 5 years (60 months)

Credit Tenure

- Up to six (6) months

Collateral

- No collateral required

Financing Scope

- Purchase of seeds, fertilizers, pest control chemicals, and field maintenance.

- Preparation costs for the field and use of machinery.

- Harvesting and transportation costs to BERNAS mills.

- Management fees for service provider offering paddy field operation management services.

Eligibility

a) Malaysian citizen.

b) Age between 18 years old (during application) up to 60 years old (end of financing tenure).

c) Company is registered under Companies Commission of Malaysia (Suruhanjaya Syarikat Malaysia (SSM);

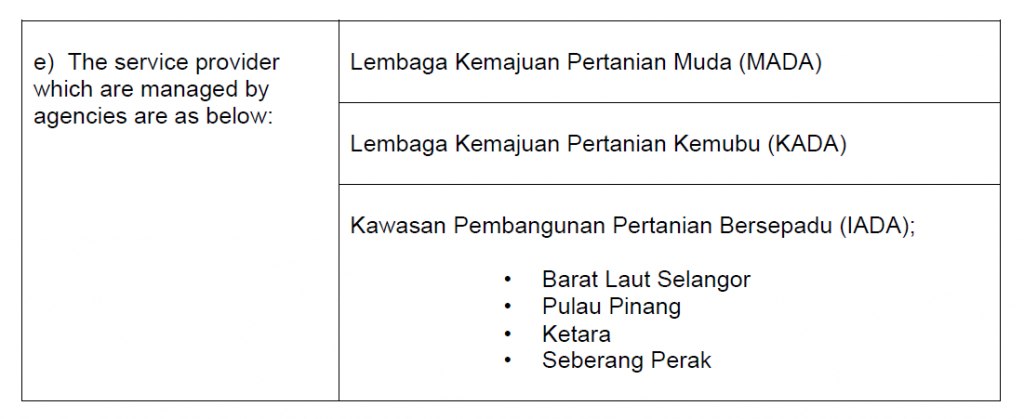

d) Service provider must be registered under BERNAS.

Document Requirement

- Appointment letter as a service provider from BERNAS;

- BERNAS confirmation letter for the details of the total operational area including the number of farmers and operational areas or any document requests related to the bank from time to time.

- Latest six (6) months’ bank statement (from all active bank account) from the date of the financing application ( 2 months from the date of financing's application is received).

- For Sdn Bhd companies, it is required to submit audited accounts not exceeding 21 months from the date of

Product Disclosure Sheet (PDS)

Frequently Asked Questions (FAQ)