-

Deposit

savings account, current account & more

-

Consumer

personal financing facilities

-

Business

business financing facilitiies

-

- Wholesaler and Retailer Program

- Pembiayaan Padi

- Program TERAJU Smart Farming

- Program PEMULIH Mikro Kredit

- Program PEMULIH NewBiz

- Program AGRO YES 2.0

- Kredit Mikro

- Program Pembiayaan Mudah Tanam Semula (TSPKS) dan Input Pertanian Pekebun Kecil Sawit (IPPKS)

- Tanaman Semula Kelapa Sawit-i (SAWIT-i)

- Term Financing-i

- Modal Kerja-i (Tawarruq)

- Machinery & Equipment Financing-i (MAEF-i)

- Agro Cash Line-i

- Strategic Alliance Financing-i (SALF-i)

- Financing Programmes

- Fund For Food (3F)

- Agro Bakti Financing Programme

-

-

-

Digital Banking

banking online in real-time, when and where it suits

-

- FPX

- JomPAY

- DuitNow

- DuitNow QR

- DuitNow Request

- Online Account Opening (Deposit)

- AGRONet Mobile

- AGRONet (Retail Internet Banking)

- AGRONetBIZ (Business Internet Banking)

- Self-Service Terminal (SST) – (ATM/CICO/CQM)

- AGROAgent (Agent Banking Services)

- E-Payment Fees & Charges

- AGRO Debit Card-i

- AGRO Business Debit Card-i

- AGRO Corporate Debit Card-i

- Co-Brand Debit Card-i

-

-

-

Services

view more services offered by us

-

TRADE FINANCE

Short-term revolving facility

CURRENT PROMOTIONS

Latest Highlights

-

Announcement 04 Apr 2024

Mega Combo 2024 (1 April sehingga 31 Julai 2024). Muat turun risalah [...]

-

Announcement 22 Mar 2024

Kempen Jom Menang Duit Raya 2024. Muat turun risalah Terma dan Syarat Soalan Lazim [...]

-

Announcement 21 Mar 2024

Mega Million Raya. Muat turun risalah Terma dan Syarat (BM) Terma dan Syarat (English) Soalan Lazim Soalan Lazim (English) [...]

-

Announcement 23 Feb 2024

Penjaja Cashless 2.0: Inisiatif Pembayaran Tanpa Tunai untuk Penjaja. Muat turun risalah Terma dan Syarat [...]

-

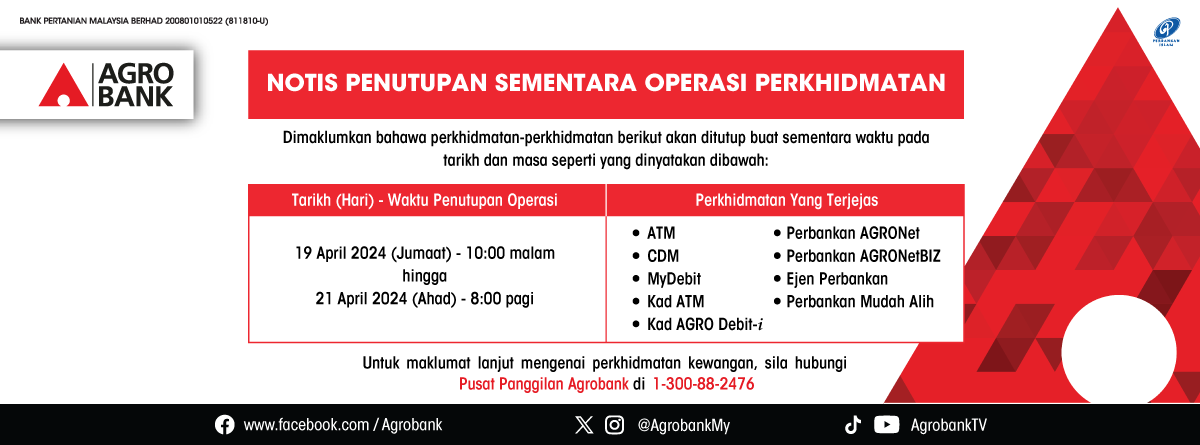

Announcement 05 Apr 2024

Notis Penutupan Sementara Operasi Perkhidmatan. – [...]

-

Announcement 03 Apr 2024

Lakukan Transaksi di luar negara atau dalam talian dengan Kad Debit Agrobank (1 April sehingga 31 Mei 2024). Muat [...]

-

Announcement 02 Apr 2024

Peraduan Kira dan Menang Emas Video Raya Mega Million. Terma dan Syarat Peraduan Kira dan Menang Emas Video Raya [...]

-

Announcement 20 Mar 2024

Inisiatif Bazar Ramadan 2024. Muat turun risalah [...]

-

Announcement 15 Mar 2024

Notis Makluman Pertukaran Pengiraan Kadar Keuntungan Kepada Harian (Daily Basis) bagi Pembiayaan Ar-Rahnu. – [...]

-

Announcement 07 Mar 2024

Kempen AGRONITA 2024: Raikan Kejayaan dan Keistimewaan Wanita. Muat Turun A5 Flyers [...]

-

Announcement 01 Mar 2024

Notis Pengemaskinian Terma dan Syarat Bagi Akaun Deposit. – [...]

-

Announcement 21 Feb 2024

Program Kelestarian Makanan Bersama Veteran Angkatan Tentera Malaysia (ATM). Muat turun risalah A5 [...]

Latest Highlights

- View All

- or view by:

-

Announcement 04 Apr 2024

Mega Combo 2024 (1 April sehingga 31 Julai 2024) [...]

Announcement 22 Mar 2024Kempen Jom Menang Duit Raya 2024 [...]

Announcement 21 Mar 2024Mega Million Raya [...]

Announcement 23 Feb 2024Penjaja Cashless 2.0: Inisiatif Pembayaran Tanpa Tunai untuk Penjaja [...]

Announcement 05 Apr 2024Notis Penutupan Sementara Operasi Perkhidmatan [...]

Announcement 03 Apr 2024Lakukan Transaksi di luar negara atau dalam talian [...]

-

Announcement 02 Apr 2024

Peraduan Kira dan Menang Emas Video Raya Mega [...]

Announcement 20 Mar 2024Inisiatif Bazar Ramadan 2024 [...]

Announcement 15 Mar 2024Notis Makluman Pertukaran Pengiraan Kadar Keuntungan Kepada Harian [...]

Announcement 07 Mar 2024Kempen AGRONITA 2024: Raikan Kejayaan dan Keistimewaan Wanita [...]

Announcement 01 Mar 2024Notis Pengemaskinian Terma dan Syarat Bagi Akaun Deposit [...]

Announcement 21 Feb 2024Program Kelestarian Makanan Bersama Veteran Angkatan Tentera Malaysia [...]

-

Announcement 01 Feb 2024

Online Account Opening (OAO) eKYC [...]

Announcement 31 Jan 2024Kempen Menang Ang Pao RM888 Heng Loong Luat [...]

Announcement 23 Jan 2024Notis Penutupan Sementara Operasi Perkhidmatan 26 Januari 2024 [...]

Announcement 15 Jan 2024AGRONetBIZ e-Welcome Pack (2023-2024) [...]

Announcement 03 Jan 2024Bantuan Banjir Agrobank 2024 [...]

Announcement 29 Dec 20232022 Annual Integrated Report [...]

Currency

MYR /gram

Buy

130.4900

Sell

138.5000

|

GOLD PRICE AR RAHNU

(17 APR 2024)

|

||

|---|---|---|

| Jenis Emas | Karat | Harga Semasa (RM) |

| Emas 999 | 24 | 420.20 |

| Emas 950 | 22.8 | 399.58 |

| Emas 916 | 22 | 385.28 |

| Emas 875 | 21 | 368.04 |

| Emas 835 | 20 | 351.21 |

| Emas 750 | 18 | 315.46 |

|

|

||

Deposit

Consumer

Business

- Wholesaler and Retailer Program

- Pembiayaan Padi

- Program TERAJU Smart Farming

- Program PEMULIH Mikro Kredit

- Program PEMULIH NewBiz

- Program AGRO YES 2.0

- Kredit Mikro

- Program Pembiayaan Mudah Tanam Semula (TSPKS) dan Input Pertanian Pekebun Kecil Sawit (IPPKS)

- Tanaman Semula Kelapa Sawit-i (SAWIT-i)

- Term Financing-i

- Modal Kerja-i (Tawarruq)

- Machinery & Equipment Financing-i (MAEF-i)

- Agro Cash Line-i

- Strategic Alliance Financing-i (SALF-i)

- Financing Programmes

- Fund For Food (3F)

- Agro Bakti Financing Programme

Digital Banking

- FPX

- JomPAY

- DuitNow

- DuitNow QR

- DuitNow Request

- Online Account Opening (Deposit)

- AGRONet Mobile

- AGRONet (Retail Internet Banking)

- AGRONetBIZ (Business Internet Banking)

- Self-Service Terminal (SST) – (ATM/CICO/CQM)

- AGROAgent (Agent Banking Services)

- E-Payment Fees & Charges

- AGRO Debit Card-i

- AGRO Business Debit Card-i

- AGRO Corporate Debit Card-i

- Co-Brand Debit Card-i

Services

© Copyright Bank Pertanian Malaysia Berhad (Agrobank) 2015 . All Rights Reserved. ICT Security Policy | Terms and Conditions | Disclaimer | Customer Service Charter

Best viewed using IE Version 9.0 or Mozilla Firefox and screen resolution of 1024 X 768

-

Deposit

savings account, current account & more

-

Consumer

personal financing facilities

-

Business

business financing facilitiies

- Wholesaler and Retailer Program

- Pembiayaan Padi

- Program TERAJU Smart Farming

- Program PEMULIH Mikro Kredit

- Program PEMULIH NewBiz

- Program AGRO YES 2.0

- Kredit Mikro

- Program Pembiayaan Mudah Tanam Semula (TSPKS) dan Input Pertanian Pekebun Kecil Sawit (IPPKS)

- Tanaman Semula Kelapa Sawit-i (SAWIT-i)

- Term Financing-i

- Modal Kerja-i (Tawarruq)

- Machinery & Equipment Financing-i (MAEF-i)

- Agro Cash Line-i

- Strategic Alliance Financing-i (SALF-i)

- Financing Programmes

- Fund For Food (3F)

- Agro Bakti Financing Programme

-

Digital Banking

banking online in real-time, when and where it suits

- FPX

- JomPAY

- DuitNow

- DuitNow QR

- DuitNow Request

- Online Account Opening (Deposit)

- AGRONet Mobile

- AGRONet (Retail Internet Banking)

- AGRONetBIZ (Business Internet Banking)

- Self-Service Terminal (SST) – (ATM/CICO/CQM)

- AGROAgent (Agent Banking Services)

- E-Payment Fees & Charges

- AGRO Debit Card-i

- AGRO Business Debit Card-i

- AGRO Corporate Debit Card-i

- Co-Brand Debit Card-i

-

Services

view more services offered by us

-

TRADE FINANCE

Short-term revolving facility